With Vice President Kamala Harris casting the tie-breaking vote, Senate Democrats accomplished something important today, over the solid opposition of their Republican colleagues. It’s a big deal. The Democratic majority in the House of Representatives now needs to approve the bill. It’s hard to imagine that won’t happen.

First, however, it should be noted that news people can’t resist attaching a dollar amount to a bill like this. The Guardian, for example, has this headline:

Senate passes $739bn healthcare and climate bill after months of wrangling.

You have to read the article to figure out what the $739 billion refers to. Is it what the government will spend? Over what period of time? Or is it what the government will collect in new taxes? When will that happen? It’s a really dumb way to point out that it’s a big piece of legislation.

Much more helpfully, here’s how The Washington Post began its analysis of the bill:

Major changes to the Affordable Care Act. The nation’s biggest-ever climate bill. The largest tax hike on corporations in decades. And dozens of lesser-known provisions that will affect millions of Americans.

The legislation Democrats muscled through the Senate on Sunday would represent one of the most consequential pieces of economic policy in recent U.S. history.

The article includes the Congressional Budget Office’s most recent analysis of what the bill will do in coming years.

There will be new spending and tax breaks amounting to $385 billion on green energy and the climate crisis (including rebates for electric vehicles and other technology) and $100 billion for improved healthcare.

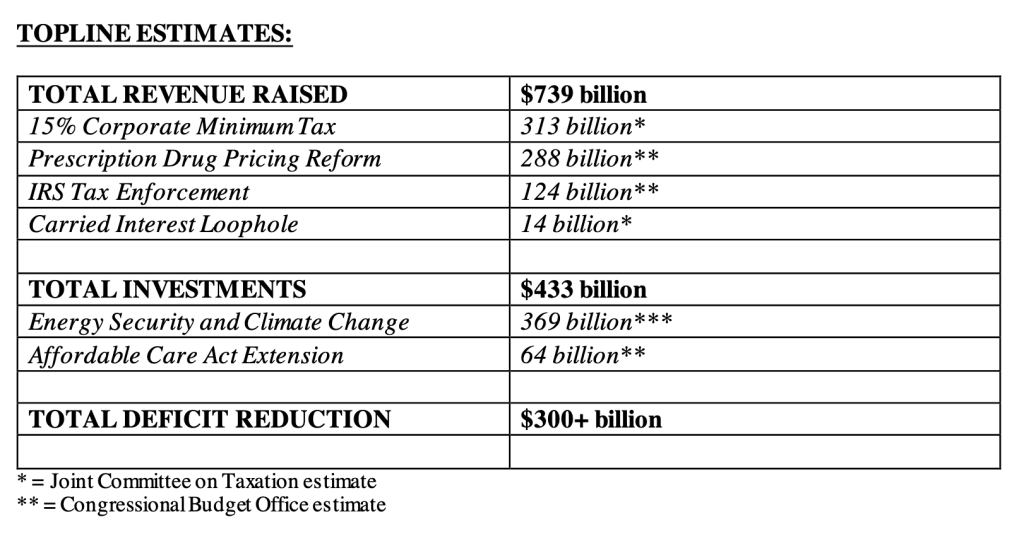

There will be increased taxes and other revenue totaling $470 billion from a new 15% minimum tax on corporations, a tax on companies buying their own stock, and a strengthened IRS, plus $320 billion in mostly drug-related healthcare savings (including allowing Medicare to negotiate drug prices).

$485 billion in spending and tax breaks and $790 billion in revenue and savings (roughly the Guardian’s number) equates to a reduction of $305 billion in the federal deficit. Lowering the federal deficit and lower prices on things like prescription drugs and green technology justified calling it the Inflation Reduction Act, although “Deficit and Inflation Reduction” would have been more accurate.

For now, a few comments. From Paul Krugman:

This was a victory for urgently needed policy. Democrats came into power with a three-part agenda: climate, infrastructure, and social programs [they delivered on infrastructure with a bit of Republican help last year].

They just delivered on the first, which was the most crucial — and no, it wasn’t far less than they sought. It accomplished most of the original objective [it’s estimated that this bill delivers about 80% of the cumulative emissions reductions over 10 years that that Biden’s original Build Back Better plan would have].

What got lost were the extensive social programs. That’s a tragedy; we could have virtually eliminated child poverty, among other things [except Sen. Joe Manchin was opposed to doing that]. Even there, this bill expanded the enhanced subsidies that have helped bring the percentage of the uninsured to a record low.

But overall, it’s a remarkable record for a party with 50 senators and a relentlessly obstructionist opposition [and two obstructive Democrats, Manchin and Sinema].

From a Washington Post reporter:

Sen. Brian Schatz of Hawaii is visibly emotional and wiping away tears after final passage of the Inflation Reduction Act. “This is a planetary emergency, and this is the first time the federal government has taken action that is worthy of the moment,” he tells reporters. “Now I can look my kids in the eye.”

And just to keep in mind who Republican politicians represent, this is from Rolling Stone:

“Republicans have just gone on the record in favor of expensive insulin,” Sen. Ron Wyden said after Republicans voted to remove an insulin price cap from the Inflation Reduction Act. “After years of tough talk about taking on insulin makers, Republicans have once against wilted in the face of heat from Big Pharma.”

Democrats needed 60 votes, according to Senate math, in order to keep the private insurance cap in the Inflation Reduction Act. While seven Republicans voted to retain the cap, that was still three senators short of the 60 needed.

Around 37.3 million Americans, 11.3 percent of the population, have diabetes. … Insulin is a “catastrophic” expense for 14 percent of the seven million Americans who need it daily, according to a Yale University study. That means those 14 percent are spending at least 40 percent of their monthly income (after paying for food and housing) on insulin.

The goods news is that the bill — at least for the moment — maintained a $35 per month cap on insulin costs for people on Medicare.

Need I mention there’s an election in three months? Make sure you’re registered and vote for Democrats up and down the ballot!

You must be logged in to post a comment.