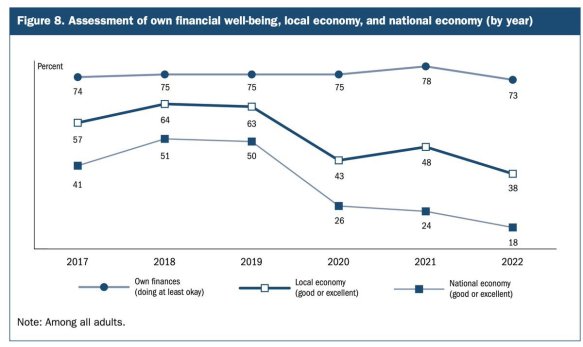

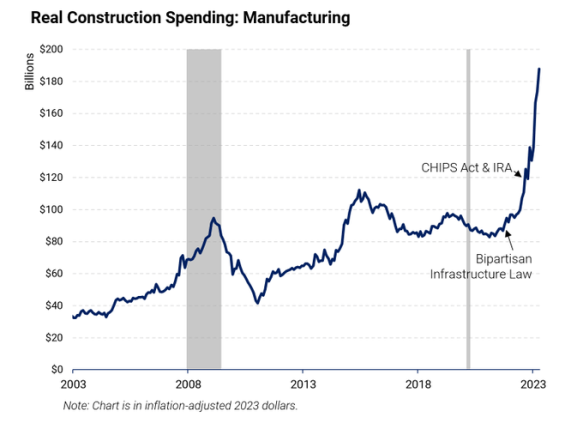

A recent poll showed that most Americans think they’re doing okay economically speaking, but think the national economy is in terrible shape. This chart is from a recent Federal Reserve report on the economic well-being of U.S. households.

The top line shows that around 75% of us have been relatively satisfied with our own finances since 2017, despite the pandemic. That 75% includes people who thought their own finances were “okay” or better. The bottom two lines, however, show that people’s opinion of their local economies and the national economy went down quite a bit during the pandemic, with lots of people thinking the country’s economy is even worse than where they live.

What’s very odd is that those negative sentiments from 2020 have lingered, or even gotten worse, even though the percentage of us who think our own finances are okay or better hasn’t changed much at all.

Another oddity is that, although people aren’t thrilled about their local economy — only 38% saying it’s good or excellent — hardly anybody likes the national economy — only 18% saying it’s good or excellent.

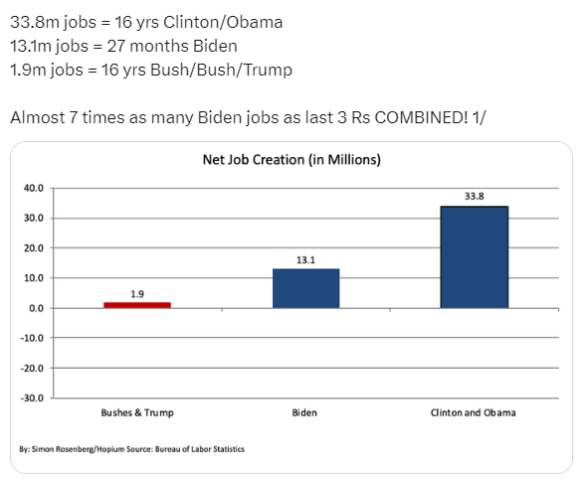

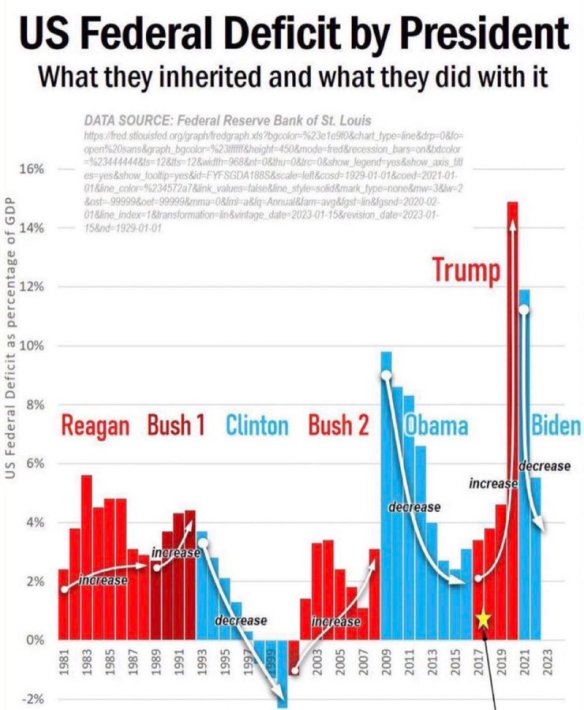

Why would so many of us think we ourselves aren’t suffering economically although people who live near us are and the nation as a whole is even worse off? The obvious answer is that the national media have convinced people that the country is in deep economic trouble, much worse than where they live and work, and despite the fact that they themselves are in pretty good shape. (It shouldn’t be a surprise that Republicans have the worst opinion of other people’s economic situation, given where they get their news and what their favorite politicians tell them.

This brings me to an article in The Washington Monthly: “Republicans Say Inflation, Crime, and Immigration Are Out of Control. The Numbers Disagree”.

The Republican presidential candidates are on the same page regarding Joe Biden: He’s a disaster on inflation, immigration, and crime.

“We have no borders. We have inflation. We have everything going wrong,” said [their leading candidate] … in his apocalyptic fashion…. “Everybody is being murdered.”

Former Vice President Mike Pence … began a CNN-hosted town hall event with a pithy critique: “Literally, we have a crisis at our border. We have inflation at a 40-year high. We have a crime wave in our cities.” Pence suggested Biden’s border policies are to blame for “a flood of fentanyl coming into every city.”

There’s one problem with this Republican portrayal of a Democratic president presiding over chaos: None of it is true.

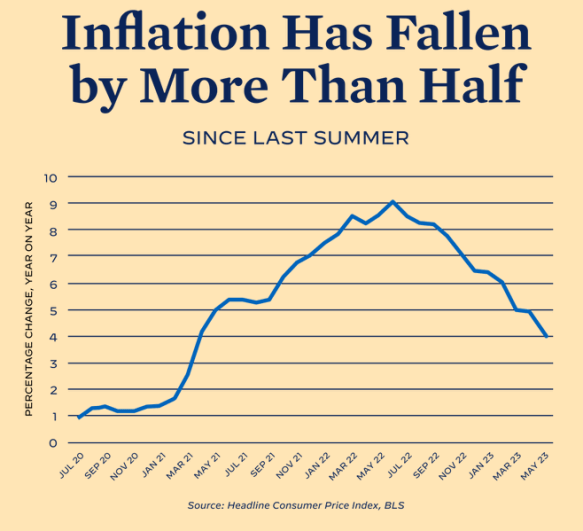

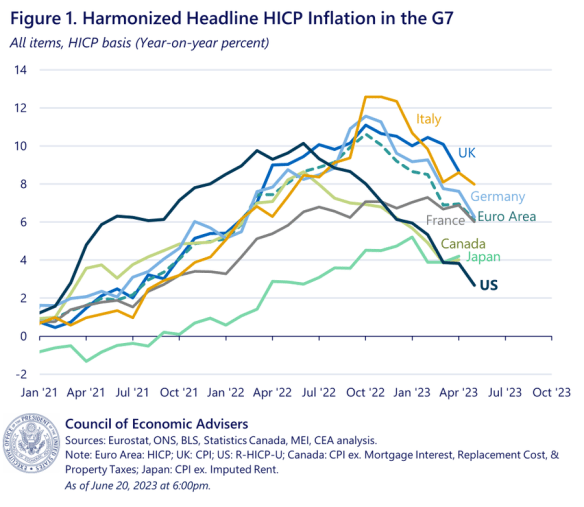

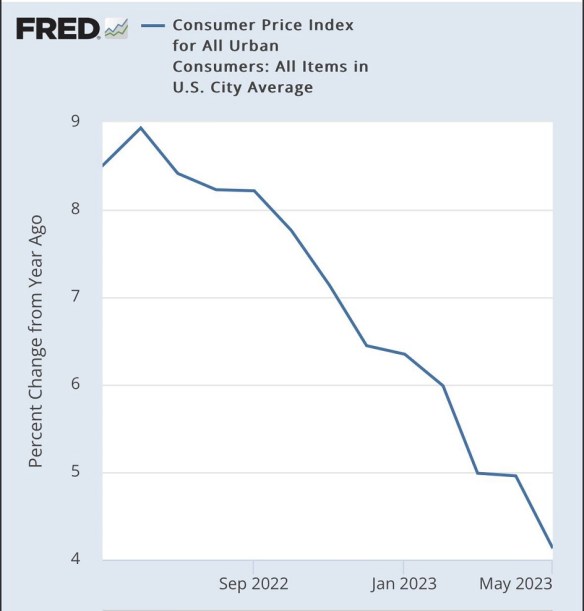

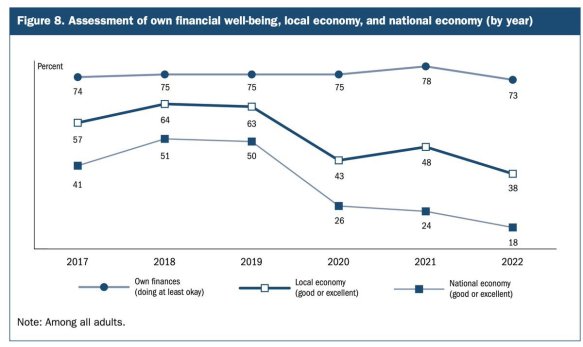

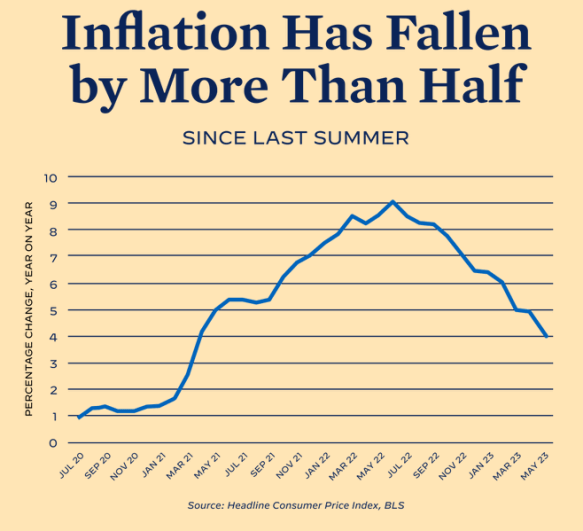

Inflation was at a 40-year high. During 2022, the inflation rate started at 7.5 percent, peaked in June at 9.1 percent, and ended the year at 6.5 percent, a mark that hadn’t been cleared since June 1982.

But 2023 is a different story. The inflation rate for May is down to 4 percent, less than half of the June 2022 peak. But even back in March, when it fell to 5 percent, the “40-year high” talking point was obsolete. In July 2008, during the George W. Bush administration, inflation was 5.6 percent. And in October and November 1990, during the George H. W. Bush administration, it was 6.3 percent.

From the Bureau of Labor Statistics:

As we get further away from the pandemic and the Federal Reserve keeps raising interest rates, the rate of inflation should continue to fall (despite the fact that corporations have used inflation as an excuse to increase their prices and profits even more than they needed to, as reported by The New York Times). Back to the article:

Has southern border security collapsed? Hardly. Unlawful entries have dropped by 70 percent in the last few weeks, according to the Department of Homeland Security, after Biden implemented a new border management policy.

… Border crossings spiked just before Biden ended “Title 42,” the public health emergency rules that Txxxx enacted in 2020, using the COVID-19 pandemic to expedite the removal of asylum-seekers…. Many skeptics … assumed that the end of Title 42 would prompt a surge of migrants. The opposite happened.

If the current pace of border crossings—about 3,700 per day—remains stable throughout June, the monthly total would be 111,000, … somewhat higher than the 93,000 in the last full month of Txxxx’s presidency.

When assessing those numbers, remember that while Title 42 made it easier for the Border Patrol to send back asylum seekers, it did nothing to prevent those removed from trying again. In turn, many of the illegal crossings in Biden’s first two and a half years—under policies designed by Txxxx—were made by repeat offenders. Between 2019 and 2022, the recidivism rate jumped from 20 to 49 percent.

In Biden’s new system, those illegally crossing the border can be banned from applying for asylum for five years and risk jail time if they violate the ban. We saw a spike in crossings just before the administration implemented the smart new policy because migrants hoped to avoid the Biden ban.To tame an unruly border, Biden is steering asylum seekers away from treacherous desert treks and towards a more orderly online application process.

What about fentanyl coming over the southern border? … Biden’s administration has intercepted more fentanyl than Txxxx’s ever did…. According to PolitiFact, Biden deserves partial credit for the higher seizure numbers because his administration is employing more and better detection technology at the border. Besides, immigration across the southern border has little to do with the fentanyl crisis. Eighty-six percent of people arrested for trafficking fentanyl are American citizens, as “the vast majority of fentanyl being smuggled in comes through ports of entry, not people trying to sneak into the country.”

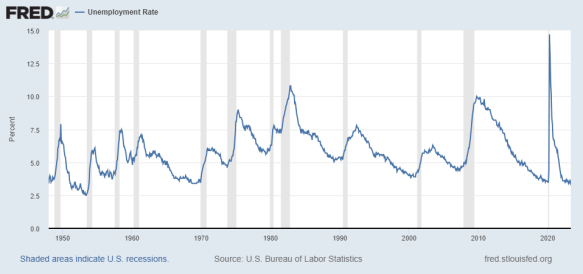

Republicans may talk up crime, and there are no shortages of alarming anecdotes, but there is no Biden crime wave. “Murder is down about 12 percent year-to-date in more than 90 cities that have released data for 2023, compared with data as of the same date in 2022,” according to …The Atlantic, a trend that could lead to “one of the largest annual percent changes in murder ever recorded.” … In fact, over the past five years, the worst month for homicides was July 2020—when Txxxx was president.

Another set of promising data comes from the Violent Crime Survey by the Major Cities Chiefs Association, which looked at data from 70 cities. During the first quarter of 2023, homicides, rapes, and robberies dropped about 8 percent from the first quarter of 2022….

Where Republicans have the best argument is in the category of stolen cars: up 21 percent from 2021 and a whopping 59 percent from 2019. But they haven’t argued that we’re only suffering from a wave of car thefts. They assert America is suffering a collapse of law and order, on every front, solely on Biden’s watch. That’s not true. A mixed picture is not a crime wave.

Republicans are not updating their talking points to reflect this new data, preferring to insist that America is falling apart. They’re betting that either the data trajectories will reverse course, belatedly validating Republican attack lines, or Americans will be so convinced everything is terrible that additional positive data won’t “feel” true, and voters will disregard it. At least, that is the Republican hope….

We can’t know what these metrics will be in the run-up to Election Day. But in the meantime, reporters and voters should not allow Republican candidates to paint a dystopian picture of America without being forced to address the numbers that don’t fit their narrative.

November 5, 2024, is more than 500 days away. Let’s hope more of the good news sinks in by then.

You must be logged in to post a comment.