The New York Times has described Heather Cox Richardson, a history professor at Boston College, as “the breakout star” of the newsletter platform Substack, where her Letters from an American has more than a million subscribers. She has a new book out called Democracy Awakening: Notes on the State of America. The Guardian calls it “a thoughtful study of how the world’s wealthiest democracy came to teeter on the precipice of authoritarianism, with an assist from [you know who]”. More from The Guardian:

[Richardson says] “the reason for the book originally was to pull together a number of essays answering the questions that everybody asks me all the time – What is the Southern Strategy? How did the parties switch sides? – but very quickly I came to realise that it was the story of how democracies can be undermined.”

Crucial in that is how history and language can be used to divide a population and convince some the only reason they have fallen behind economically, socially or culturally is because of an enemy. The antidote, Richardson argues, is an explicitly democratic history “based in the idea that marginalised populations have always kept the principles of the Declaration of Independence front and centre in our history”.

She is not pulling punches. Her preface observes that the crisis in American democracy crept up on many and draws a direct comparison with the rise of Adolf Hitler, achieved through political gains and consolidation.

“Democracies die more often through the ballot box than at gunpoint,” she writes.

America’s current malaise, she argues, began in the same decade: the 1930s. It was then that Republicans who loathed business regulations in Franklin Roosevelt’s New Deal began to consider an alliance with southern Democrats, who found Roosevelt’s programmes insufficiently segregationist, and western Democrats who resented the idea of the federal government protecting land and water. In 1937, this unholy coalition came up with a “Conservative Manifesto”.

Richardson says: “When it gets leaked to the newspapers, they all run like rats from it… They all disavow it, but that manifesto gets reprinted all over the country in pro-business and racist newspapers and pamphlets and it has very long legs.

“They want to get rid of business regulation, they want to get rid of a basic social safety net and send all that back to the churches, they want to get rid of infrastructure projects that FDR is engaging in because they think it costs too much in tax dollars and it should be private investment. They don’t really talk about civil rights because because FDR is really just flirting with the idea of equality in the New Deal programmes, but they do say they want home rule and states’ rights, which is code for “We don’t want civil rights.’”

These four principles would become a blueprint for Republicans such as Barry Goldwater and Ronald Reagan, language sometimes mapping directly. In the early 1970s, Richardson contends, Republicans began to pursue anti-democratic strategies such as gerrymandering and shifting the judiciary rightwards. They also spent decades waging an “information war”.

A prime example was the 1998 impeachment of Bill Clinton, an attempt to convince the public he was not a legitimate president.

“That era is when congressional investigations to smear the Democrats take off,” Richardson says. “Those investigations don’t turn up anything but it doesn’t matter because it keeps it in front of the American people – the idea that something is there.”

Enter [T], a blowhard who turned disinformation into an artform in the business world and become a reality TV star. He promised Christian conservatives he would appoint rightwing judges; he promised fiscal conservatives he would cut taxes; he promised the white working class he understood their resentments. He made the party his own….

“[T] is an interesting character because he’s not a politician. He’s a salesman and that is an important distinction because in 2016 he held up a mirror to a certain part of the American population [note: a white part], one that had been gutted by the legislation that has passed since 1981, and gave them what they wanted.

“If you remember in 2016, he was the most moderate Republican on that stage on economic issues. He talked about infrastructure, fair taxes, cheaper and better healthcare, bringing back manufacturing. He talked about all those economic issues but then he also had the racism and the sexism and of course that’s what he was really going for, that anger that he could tap into.

“Tapping into that anger was crucial to him forging an authoritarian movement, because at least in the United States the authoritarian rightwing movements have always come from street violence rather than the top and from ideas of what fascism should look like. He quite deliberately tapped into that emotional anger that he could spark with racism and sexism.”

Richardson is again not bashful about invoking the Nazi comparison when she cites the communications scholar Michael Socolow’s observation that [T’s] 2020 State of the Union address, in which he demonstrated that he could “raise hurting individuals up to glory”, mirrored the performances of Hitler, who sought to show an almost magical power to change lives….

Despite 91 criminal charges, Trump dominates the Republican primary….What would a second [T] term mean for America?

“An end of American democracy. I have absolutely no doubt about that, and he’s made it very clear. You look at Project 2025, which is a thousand pages on how you dismantle the federal government that has protected civil rights, provided a basic social safety net, regulated business and promoted infrastructure since 1933. The theme of his 2024 campaign is retribution.

“I don’t think people understand now that, if he wins again, what we’re going to put in power is those people who want to burn it all down. By that I mean they want to hurt their enemies for sure but, so long as they can be in control, they don’t care if it means that Nato falls apart or that Americans are starving or dying from pandemic diseases.”

Biden understands the threat. Last month in Phoenix, he issued another stark warning…. Richardson casts a historian’s eye at his record.

“Biden is a fascinating character in that in that he is one of the very few people who could have met this moment. I was not a Biden supporter, to be honest. I thought we needed somebody new and much more aggressive, and yet I completely admit I was wrong because he has, first of all, a very deep understanding of foreign affairs….

“I thought in 2020 that was not going to matter and could I have been more wrong? I think not. That really mattered and continues to matter in that one of the reasons Republicans are backing off of Ukraine right now is that they recognise, [although] it’s not hitting the United States newspapers, Ukraine is actually making important gains. A win from the Ukrainians would really boost Biden’s re-election. The Republicans recognise that and are willing to scuttle it so long as it means they can regain power….

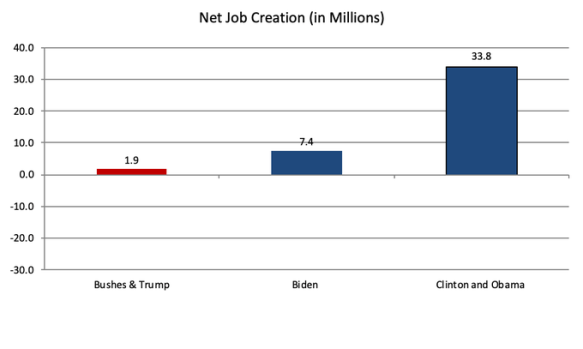

“The other thing about Biden is his extraordinary skill at dealmaking has made this domestic administration the most effective since at least the Great Society and probably the New Deal. You think about the fact that [T] could never get infrastructure through Congress, even though everybody wanted it.

“That has been huge but … he needs to prove that the government can work for people after 40 years in which we had a government that we felt was working against us. That has been a harder and harder case for him to make because the media is not picking that up.

“The question going into 2024 is: will people understand that Biden has created a government that does work for the people? Whether or not you like its policies personally, he is trying to use that government to meet the needs of the people in a way that the Republicans haven’t done since 1981. He is a transformative president. Whether or not it’s going to be enough, we’re going to find out in 14 months”.

“I watch him constantly, I read him constantly, and I have met him and interviewed him. He’s fine mentally. As I get older, when I’m on task, I don’t miss a trick. I’m going to leave to go to the grocery store after this, and the chances are very good I will run into somebody I know quite well and not remember their name. That’s just the way it is.”

Richardson glides between excavations of 19th-century history and a running commentary on the hot political story of the day….

She reflects: “One of the things that people like me do is give people firm ground to stand on in a swamp. That is, … to have somebody say, ‘This happened, this happened, this happened and here are citations that you can go to check, and this is how things work,’ is very comforting…. “So it’s partly a search for history but it’s also partly a search to feel like you understand the world again, which is hard to do when you’re being bombarded with hearings and lies and all that kind of crap. I actually think that the meaning of it is less about history than it is about returning to a reality based community.”

You must be logged in to post a comment.