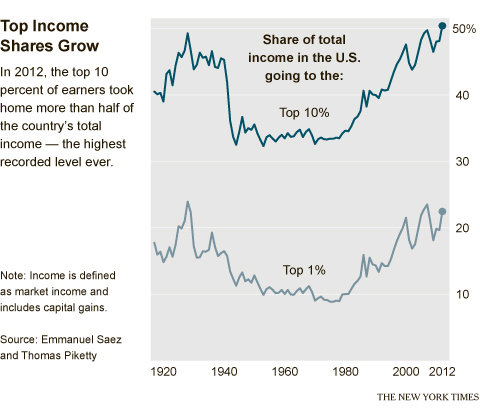

An updated study by economist Emanuel Saez of U.C. Berkeley shows that the the top 1% of earners in the United States received more than 20% of the country’s total income in 2012, while the top 10% of earners received more than half of the country’s income. The share of income going to the wealthiest Americans is now at or near the highest levels on record since the government began keeping the relevant statistics and the federal income tax was created in 1913.

What’s even more remarkable, perhaps, is that the income of the top 1% went up nearly 20% in 2012, while the income of the remaining 99% rose only 1%. Since 2009, the wealthiest 1% have taken 95% of the income gains in our supposedly classless society.

We should remember these statistics when we hear Republican politicians, who pretend to be friends of the middle class, claim that lower taxes for the wealthy benefit everyone. It’s past time to raise taxes on the rich, invest in America’s infrastructure and start creating decent jobs again. Otherwise we’re going to continue to get economically screwed.

Note the year 1980 in this chart, when class warrior and demagogue supreme Ronald Reagan was elected President:

http://takingnote.blogs.nytimes.com/2013/09/11/the-rich-got-richer/

You must be logged in to post a comment.