If you’re feeling too optimistic about the future and want a bracing jolt of economic reality, you might want to read Paul Krugman’s latest column. It’s called “A Permanent Slump?“

Professor Krugman considers the possibility that the normal state of our economy is now mild depression (what psychiatrists call “chronic dysthymia” in another context). He describes it as “a persistent state in which a depressed economy is the norm, with episodes of full employment few and far between”.

Krugman points out that the economy hasn’t done especially well for most people in recent decades, even when we were in the midst of a housing bubble and consumers were taking on increasing amounts of debt. By now, the economy should have recovered nicely from the financial crisis of 2007-2009, but it hasn’t. As he puts it:

The evidence suggests that we have become an economy whose normal state is one of mild depression, whose brief episodes of prosperity occur only thanks to bubbles and unsustainable borrowing.

I went out to rake leaves after reading this. It was a beautiful fall day, very conducive to deep thoughts about politics and the economy. After ruling out the violent overthrow of the government, I concluded that there are a couple of things we need to do.

1) Establish a guaranteed minimum income, like Switzerland is considering. If too many people can’t find a decent job in this country, let’s at least make sure the worst off have a reasonable amount of money to live on. Maybe we don’t need as many people working as we used to, back before the “Information Revolution” and the “Global Economy”. Danny Vinik of the Business Insider makes a strong case here. He argues, for example, that most people would still want to work. I think one important result would be that the economy as a whole would benefit if people with low incomes had more money to spread around.

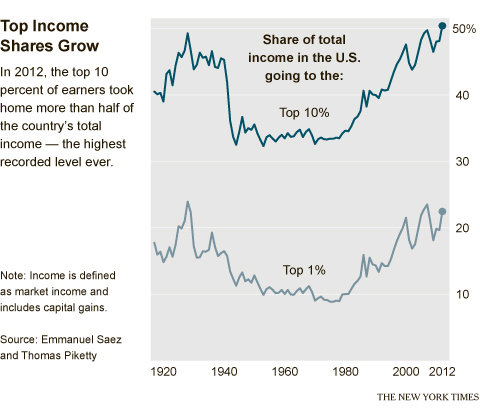

2) Bring back the progressive income tax, like we used to have when this country worked well for the majority of people. As recently as 1963, the highest tax rate was 90%. Of course, that doesn’t mean that someone making a million dollars a year (who made that kind of money back then?) had to pay $900,000 in federal taxes. The 90% rate applied to income above a certain threshold. As recently as 1980, the highest rate was 70%. Now, after the “Reagan Revolution”, it’s 35%. We’re still waiting for the wealth to trickle down. It might be the case that lots of billionaires and multi-millionaires would move to the Bahamas. (Good riddance.) But it would allow us to move away from being a “Winner Take All Society“.

You must be logged in to post a comment.