Historian Sean Wilentz makes a forceful argument in favor of Obama invoking the 14th Amendment to protect the world’s economy:

… the president would have done his constitutional duty, saved the country and undoubtedly earned the gratitude of a relieved people. Then the people would find the opportunity to punish those who vandalized the Constitution and brought the country to the brink of ruin.

http://www.nytimes.com/2013/10/08/opinion/obamas-options.html?pagewanted=2&hp

The New York Times editorial board is justifiably outraged that many people living in Republican-run states will still lack health insurance next year — they’ll earn too little to be covered by the Affordable Care Act and too much to be covered by Medicaid:

Their plight is a result of the Supreme Court’s decision last year that struck down the reform law’s mandatory expansion of Medicaid and made expansion optional. Every state in the Deep South except Arkansas has rejected expansion, as have Republican-led states elsewhere, [although] there is no provision in the ACA to provide health insurance subsidies for anyone below the poverty line … those people are supposed to be covered by Medicaid… Eight million Americans who are impoverished and uninsured will be ineligible for help of either kind.

http://www.nytimes.com/2013/10/04/opinion/a-population-betrayed.html?ref=opinion

Of course, Congress could easily fix this problem, but that would require You Know Who to cooperate.

At Jacobin, Shawn Gude writes about the fundamental tension between capitalism and democracy, in the context of living-wage legislation in the District of Columbia:

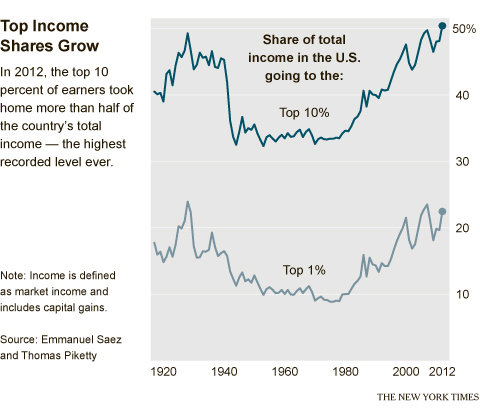

The controversy throws into sharp relief one of our era’s great unspoken truths: Capitalist democracy, if not an oxymoron, is less a placid pairing than an acrimonious amalgamation. The marriage that Francis Fukuyama famously pronounced eternal is in fact a union of opposites. Inherent to capitalism is inequality, fundamental to democracy is equality. Class stratification, the lifeblood of capitalism, leaves democracy comatose. The economic “base,” to put it in classical Marxian terms, actively undermines the purported values of the political superstructure.

And finally, Nobel Prize-winning economist Joseph Stiglitz argues that we can undo the decisions that got us into this mess:

We have become the advanced country with the highest level of inequality, with the greatest divide between the rich and the poor… The central message of my book, The Price of Inequality, is that all of us, rich and poor, are footing the bill for this yawning gap. And that this inequality is not inevitable. It is not … like the weather, something that just happens to us. It is not the result of the laws of nature or the laws of economics. Rather, it is something that we create, by our policies, by what we do.

We created this inequality—chose it, really—with laws that weakened unions, that eroded our minimum wage to the lowest level, in real terms, since the 1950s, with laws that allowed CEO’s to take a bigger slice of the corporate pie, bankruptcy laws that put Wall Street’s toxic innovations ahead of workers. We made it nearly impossible for student debt to be forgiven. We underinvested in education. We taxed gamblers in the stock market at lower rates than workers, and encouraged investment overseas rather than at home.

Meanwhile, the Swiss are voting on whether to guarantee everybody a minimum monthly income of $2500 francs ($2800 dollars). They’re also voting on a proposal to limit executive pay to no more than 12 times what the company’s lowest-paid workers earn. Who knew that the businesslike, orderly Swiss were a bunch of commies? Or maybe they’re just fed up with rising inequality, even in Switzerland.

http://www.reuters.com/article/2013/10/04/us-swiss-pay-idUSBRE9930O620131004

You must be logged in to post a comment.